In the fast-evolving world of artificial intelligence, where chatbots like OpenAI’s ChatGPT and Anthropic’s Claude have become household names, Apple has long been seen as the quiet observer—innovating behind the scenes but rarely leading the charge. In early August 2025, reports came out that the tech giant from Cupertino is making its own “answer engine,” a streamlined AI tool that is meant to compete with its competitors’ conversational skills.

This changed people’s minds about how they saw the company. Mark Gurman, a tech journalist for Bloomberg, wrote about this move. It shows that Apple wants to get back into a market where other companies are in charge. It makes people wonder: Could Apple’s entry change how we use AI, or is it too late to change the way things are done?

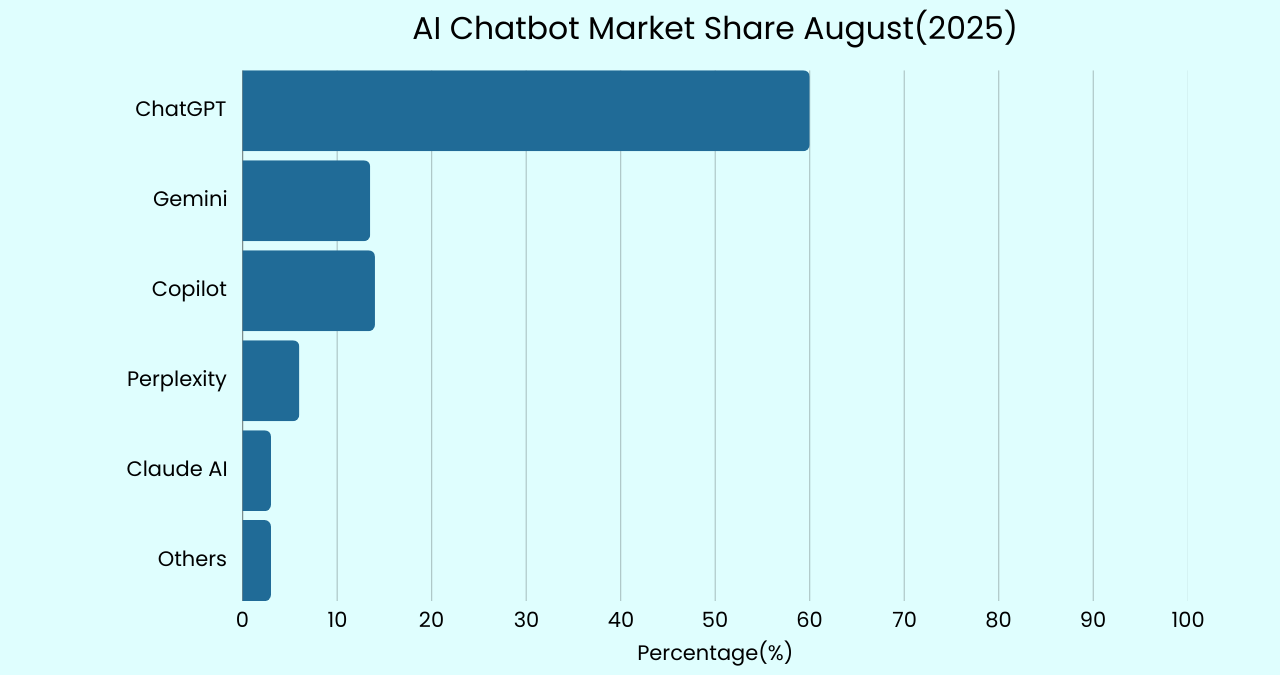

Apple’s move into this area isn’t just to catch up; it’s a strategic shift that could change the way chatbots work. Statcounter data shows that ChatGPT had more than 80% of the market for generative AI chatbots as of August 2025. Claude is also gaining popularity for its focus on ethical AI. Apple’s “Answers” team wants to stand out by focusing on privacy, easy integration with devices, and getting reliable, real-world information.

But to get the full picture, we need to look at Apple’s past with AI, the specifics of this new project, and what it means for the “chatbot war” that is still going on.

The AI Chatbot Boom: Where Apple Has Stood Until Now

The rise of generative AI chatbots has been nothing short of revolutionary. Since ChatGPT came out in late 2022, it has gained billions of users and changed everything from student homework to business decisions.

According to a study by OneLittleWeb, ChatGPT’s visits had grown by 106% year-over-year to 46.6 billion by the middle of 2025, solidifying its position as the most popular site. Close behind are Google’s Gemini (formerly Bard) with about 16% market share, Microsoft’s Copilot at 4.5%, and emerging players like Anthropic’s Claude and xAI’s Grok, each holding smaller but growing slices. These tools excel at natural language processing, offering everything from creative writing to code debugging.

Apple, meanwhile, has played a more subdued role. The company’s AI work has mostly been focused on “Apple Intelligence,” a set of features that came out with the iPhone 16 in 2024. These include better Siri features, Image Playground for making images, and writing tools, all of which are powered by a mix of in-house models and partnerships.

Apple’s use of OpenAI’s ChatGPT in Siri to handle difficult questions is a good example of how they used outside expertise without having to build a full chatbot from scratch. At WWDC 2024, Apple announced this partnership, which let Siri use ChatGPT to get answers from the web. However, it also showed how much Apple depends on other people.

Interesting Reads:

Why Tech Layoffs Are Rising in 2025 – And It’s Not Because of AI

Perplexity Launches Comet AI Browser That Could Replace Recruiters & Assistants

In the past, Apple’s AI strategy has favored buying other companies and making small improvements instead of making big, public announcements. The company has bought more than 30 AI startups since 2018, when it hired Google’s AI chief John Giannandrea. Seven of those were in 2025 alone. Investments have been massive: Apple pledged $500 billion in U.S. spending over four years starting in 2025, with a significant portion earmarked for AI infrastructure, making chips, and research and development.

But critics say that these efforts have not been enough. For example, Siri’s full AI overhaul, which was supposed to be ready for iOS 19, is still in beta, and internal models have not been able to keep up with competitors in benchmarks.

Apple’s Big Pivot: The Birth of the ‘Answers’ Team

The tide turned with the formation of the “Answers, Knowledge, and Information” (AKI) team earlier in 2025. According to Gurman’s report, this group is tasked with creating a “stripped-down rival to ChatGPT” that focuses on providing accurate, web-crawled responses to user queries. Unlike the verbose, creative outputs of ChatGPT or Claude, Apple’s answer engine prioritizes efficiency and integration—potentially as a standalone app or enhancements to Siri, Spotlight Search, and Safari.

This change means that Apple is no longer relying on partnerships as much as it used to. Apple thought about replacing its own Siri technology with models from Anthropic or OpenAI in June 2025, but costs and privacy concerns made it decide to build its own. Tim Cook, in a rare all-hands meeting post-earnings in August 2025, emphasized AI’s transformative potential, calling it “as big or bigger” than the internet or smartphones. “This is ours to grab,” he told employees, committing to “significantly increasing” AI spending and openness to more acquisitions.

Apple’s CapEx is projected to hit $14 billion annually by year’s end, funding custom AI chips like “Baltra” and a new server plant in Houston. Internally, executives believe their chatbot prototypes are now “on par” with recent ChatGPT versions, a marked improvement from six months prior. But there are still problems: important employees have left for competitors like Meta and OpenAI, saying they offer better pay and more advanced technology.

To illustrate the competitive landscape, consider this bar chart of 2025 AI chatbot market shares (based on global usage data from Statcounter and similar sources):

This visual underscores ChatGPT’s lead, but Apple’s ecosystem—over 2 billion active devices—could accelerate adoption if its tool integrates seamlessly.

Implications for ChatGPT and Claude: A Collision Course?

Apple’s entry poses direct threats to OpenAI and Anthropic. ChatGPT, while integrated into Apple devices, could see reduced usage if Apple’s native tool handles queries better on-device, preserving privacy without cloud reliance. OpenAI and Apple are working together, and they share money from subscriptions. This could turn into competition. Claude is also under pressure because Apple is focusing on ethical AI, which could steal users who care about data security.

On X, the buzz is palpable. Tech analyst Mark Gurman (@markgurman) posted on August 3, 2025: “Power On: Apple has a new “Answers” team working on a stripped-down alternative to ChatGPT for world knowledge as it looks to catch up in AI.”. Other users, like @9to5mac, echoed: “Apple now looking to rival ChatGPT with a new in-house ‘Answers’ team: report”. These posts highlight community excitement and skepticism.

Geopolitically, Apple’s push aligns with U.S. efforts to bolster domestic AI amid tensions with China, where it may partner with Baidu. For consumers, this could mean more choices: Apple’s tool might excel in everyday tasks like recipe suggestions or travel planning, integrated into iOS without switching apps.

Looking Ahead: Can Apple Redefine the Chatbot War?

Apple’s history of entering markets late but dominating—think smartphones or wearables—suggests potential success. Analysts say that by 2027, AI features could lead to a supercycle of iPhone upgrades, with sales possibly reaching 250 million units. But there are still problems: combining Siri’s old code with new AI has slowed things down, and competitors like Grok (from xAI) are getting better at handling real-time data very quickly.

In the end, Apple’s “answer engine” isn’t just another product; it’s a declaration of war in the AI space. ChatGPT and Claude are doing well, but Apple’s focus on privacy and ecosystem advantages could change the game. Cook said that this is Apple’s to take. Whether it succeeds will depend on execution, but one thing’s clear: The chatbot war just got a lot more interesting.